- ALE Property (LEP) triumphs in its Victorian Supreme Court case over rental judgments issued in error in 2018

- In September of 2020 ALE received the 2018 rent determinations from five independent determining valuers, ALE considered 19 determinations to be erroneous

- The Court rules that ALE is entitled to a declaration that the 2018 rent decisions in Victoria were not made in line with the leases, are not binding, and must be redone

- The judgment has no bearing on ALE’s and the Charter Hall Consortium’s rights and duties under the scheme implementation deed published on September 20

- Fresh out of a trading halt, shares in LEP are up 0.72 per cent at $5.60 at 1:57 pm AEDT

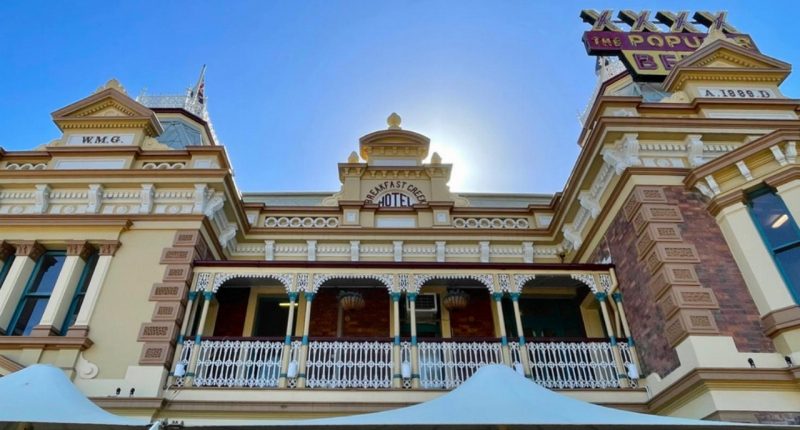

Publican ALE Property (LEP) has emerged triumphant in its Victorian Supreme Court case regarding rental determinations ALE claimed were made in error in 2018.

In September 2020 ALE received the 2018 rent determinations from five independent determining valuers, assessing the rents of 43 properties.

After reviewing the determinations, ALE considered that the determinations in relation to 19 Victorian properties were not made in accordance with the requirements of the rent review provisions of the relevant leases.

As a result, ALE filed proceedings in the Supreme Court of Victoria in October 2020 seeking declarations that the 19 Victorian Determinations are not binding on the parties.

Since launching court proceedings, ALE sold three of the 19 properties, which were subsequently removed from litigation.

Specifically, ALE claimed that the valuer erred by not considering an estimate of earnings before interest, taxes, depreciation, amortisation, and restructuring or rent costs (EBITDAR) based on what a “good average” manager would have achieved in regard to each of the Victorian properties, and considering a submission from the tenant that the valuer was not allowed to consider.

Yesterday, the Court issued its decision in those matters. The Court ruled that ALE is entitled to a declaration that the 2018 rent decisions in Victoria were not made in line with the leases, are not binding, and must be redone.

In reaching that conclusion, the Court reviewed the two grounds on which ALE claimed the valuer erred and concluded, among other things, that the valuer appropriately understood and implemented the valuation methodology.

There was no requirement in the valuation methodology to assess rental on the basis of a good average manager, though the valuer was free to do so if he or she thought it was appropriate.

The court also held that the valuer took into account a submission from the tenant relating to the tenant’s EBITDA information, which the valuer was not allowed to take into account.

Subject to both parties’ appeal rights, ALE and the tenant will need to work together to agree on a mechanism for repeating the 2018 rent decisions in Victoria.

Charter Hall Long WALE REIT (CLW) and a Charter Hall managed trust has engaged in a $1.68 billion transaction to buy ALE Property on behalf of Hostplus.

While ALE is presently reviewing the ruling and analysing the consequences of the Court’s decision, the judgment has no bearing on ALE’s and the Charter Hall Consortium’s rights and duties under the scheme implementation deed published on September 20.

In the coming weeks, ALE plans to release a scheme booklet relating to the Charter Hall Consortium proposal, which will include a full explanation of the directors’ decision as well as an independent expert’s report.

Fresh out of a trading halt, shares in LEP are up 0.72 per cent to $5.60 at 1:57 AEDT.