Attractive investments in the junior mining space lack market recognition, despite considerably de-risked paths to value creation backed by operational and macroeconomic data.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

A gold explorer, developer, and soon-to-be producer set up to win under this rubric is Quebec-based LaFleur Minerals (CSE:LFLR).

It has a market capitalization of C$15.22 million and its stock has given back 17% since acquiring its flagship Swanson Gold project in July 2024 – even though the company has positioned itself for near-term production as gold hovers near all-time-highs.

Key phases along that timeline include:

- Securing 100-per-cent ownership of the Swanson project in July 2024.

- Establishing the project’s NI 43-101 compliant mineral resource estimate of 123,400 ounces of gold indicated and 64,500 ounces inferred in September 2024, optimized with a price of US$1,850 per ounce of gold, heavily discounted to the price of US$2,954 as of February 20.

- Securing the nearby Beacon mill in October 2024 for only C$1.1 million, enabling both in-house mineral processing and third-party processing from numerous nearby deposits.

- Executing on an ongoing 2025 exploration plan focused on quintupling contained gold to over one million ounces, supported by a leadership team with 30% insider ownership and decorated track records spanning mine development, precious metals exploration and hundreds of millions of dollars in capital raised.

Let’s explore LaFleur’s two primary assets to better understand why they hold the potential to deliver significant long-term value.

The Swanson gold project

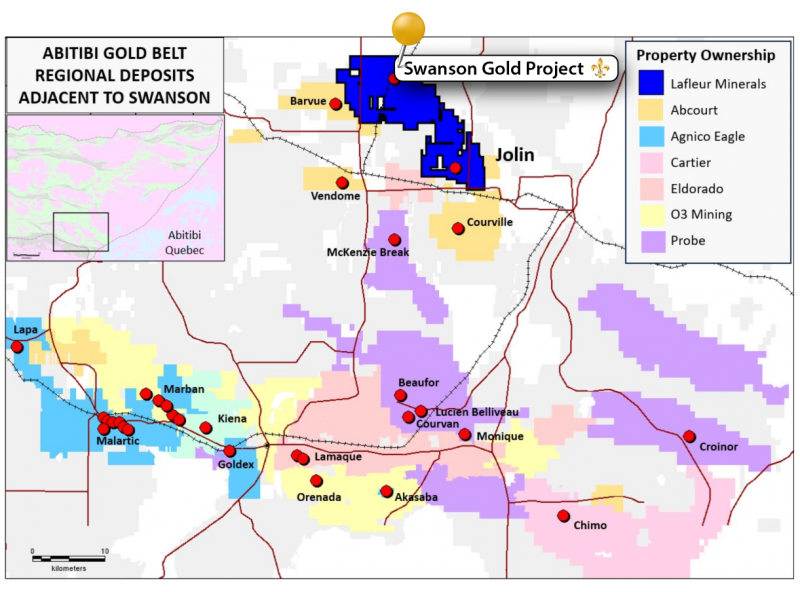

The 15,290-hectare Swanson project resides in mining-friendly Quebec, specifically in the world-renowned Abitibi Greenstone Belt, which has been a leading contributor to Canadian gold exploration and production for over a century.

Swanson boasts 22 gold showings, as well as critical mineral showings housing silver, copper, zinc, lead, and molybdenum, all near robust infrastructure and situated along a volcanic corridor up to seven kilometres wide and 27km along strike.

Mineralization is hosted by ultramafics (fuchsite), altered mafic volcanics and syenite intrusions, which can indicate the presence of high-grade gold and visible gold.

Swanson’s substantiates its proximity to numerous gold producers (slide eight) including Agnico Eagle and Eldorado, as well as developers such as Probe Gold and O3 Mining, with a value-added 2024 mineral resource estimate that achieved an 8% increase in indicated gold ounces and a 626% increase in the number of inferred ounces compared to a 2021 historical estimate. This doesn’t account for the project’s untapped exploration upside, as highlighted by:

- The Jolin deposit (slide 15) and its non-compliant underground resource estimated at 190,000 tons at 6.6 grams per ton (g/t) of gold indicated and 250,000 tons grading 8.2 g/t gold inferred.

- The Bartec deposit, hosting a non-compliant underground resource of 113,400 tons grading 7.9 g/t gold.

- Over 11,000 m of prospective historical drilling by previous owner Monarch Mining yielding broad zones of gold mineralization over 200 metres wide.

- Several favourable gold-bearing regional structures and deformation corridors that extend across the property and remain to be fully explored.

To continue fostering Swanson’s ounce-count and shareholder value, LaFleur recently completed a high-resolution airborne magnetics and very low frequency electromagnetic (VLF-EM) geophysics program over the Swanson gold deposit, with management interpreting the results.

Additionally, assays from soil geochemistry and prospecting programs remain pending, offering a multitude of vectors to define drill targets and clarify the full extent of the deposit’s value proposition.

To this multitude, LaFleur is adding further mapping and prospecting covering the Bartec and Jolin deposits, as well as other prospective areas of the Swanson project’s over 15,000-hectare land package, in addition to an induced polarization-resistivity ground geophysics survey over 166 line-km scheduled between January and February 2025.

Management expects to begin up to 10,000 metres of drilling by mid-2025, contingent on permitting, with the goals of increasing project resources to over one million ounces of gold and continuing ongoing work to update Agnico Eagle’s 2009 preliminary economic assessment (PEA) under an open-pit scenario.

According to Louis Martin, LaFleur’s technical advisor and exploration manager, ongoing exploration efforts position the company to exploit low-hanging fruit – beginning with the Swanson deposit’s surface-level open-pit portion – thanks to its recently acquired Beacon mill, paving the way for self-funding the development of the project’s underground prospectivity.

The Beacon gold mill and mine

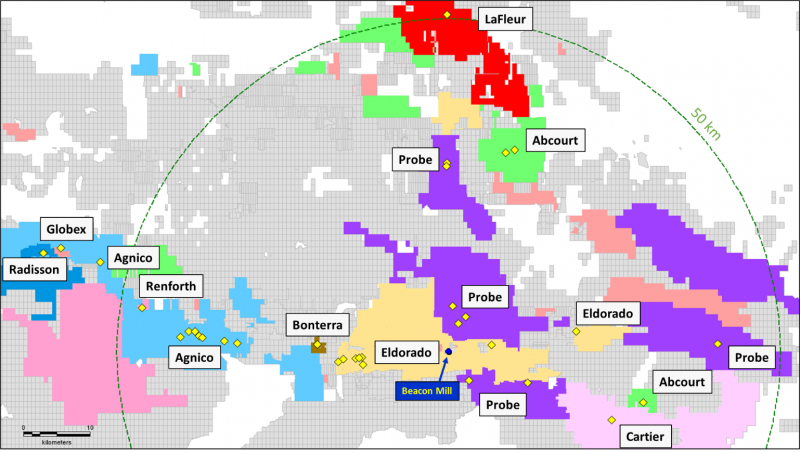

LaFleur’s go-to-market strategy focuses on the fully permitted Beacon mill and past-producing gold mine, located within 50 kilometres of the Swanson gold deposit and along the southeast contact of the Bourlamaque Batholith near numerous gold mines, including Wrightbar, Beaufor, and Lamaque, many of which lack in-house processing infrastructure.

The mill is equipped to process 750 tons per day (tpd) after undergoing C$20 million in refurbishments by previous owner Monarch Mining in 2021-2022, but has been under care and maintenance since early 2023.

The Beacon land package also includes a tailings management pond, underground installations, a 500-metre shaft and headframe, a ramp and a mechanical shop from the Beacon mine, saving LaFleur tens of millions of dollars compared to building a facility from scratch and enabling the company to more easily scale its way towards lower costs and higher profitability.

The Quebec Government has also authorized the company to process up to 1.8 million tons of tailings, representing about nine years of mineral processing at full capacity, expanding the facility’s revenue generation capabilities.

LaFleur recently initiated high-level pre-feasibility work to restart the Beacon mill with feed from the Swanson project, including Bartec and Jolin, and is partnering with local mining services contractor ABF Mines to refine its approach regarding staffing, ongoing maintenance and repairs, and potential production upgrades.

Initial results from this work, expected in Q1 2025, will inform the path to production, backed by C$2.8M raised in December 2024 for further drilling, advancing economic studies and upgrading resources to reserves.

According to Paul Ténière, LaFleur’s chief executive officer, LaFleur is focused on generating near-term cash flow from Beacon through third-party feed to self-fund it growth plans, including ushering the Swanson deposit towards an open-pit operation over the next 12 to 18 months, working to establish resources at Bartec and Jolin, and continuing to explore the project’s district-scale land package.

Numerous parties at the PEA and PFS level with nearby up to multi-million-ounce deposits are in discussions with the company about processing their ore and potentially funding the mill’s restart.

A clear path to revenue generation

With its stock last trading at C$0.29, having lost almost one fifth of its value since July 2024, LaFleur’s production and resource expansion upside and gold’s recent run-up to all-time-highs have yet to be priced in.

This dynamic lays the groundwork for a potentially significant share price re-rating contingent on the gold price remaining strong in line with expectations from Goldman Sachs, UBS and Deutsche Bank, among other leading financial institutions, facilitating LaFleur’s path to validating and initiating production, unlocking cash flow and building scale to better capitalize on opportunities regardless of gold market conditions.

From Ténière’s perspective, this re-rating may come in the form of mergers or partnerships, with LaFleur engaged in numerous ongoing discussions with groups as far as Australia to optimize shareholder value creation.

This interest in LaFleur’s assets, according to Martin, is thanks to the company’s diligent development, growing Monarch Mining’s initial two mineral showings to over 25. Further strategic expansion deals are currently being ironed out to enhance exposure to the Swanson project’s mineralized envelope, in which he sees multi-million-ounce potential.

With upcoming prospecting, surveying, drilling and deal flow serving as potential catalysts towards greater market awareness, LaFleur likely won’t be trading under the radar for long.

Join the discussion: Find out what everybody’s saying about this Canadian gold mining stock on the LaFleur Minerals Inc. Bullboard today.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.