- With the rise in house prices and debt, financial stability risks may be increasing, RBA assistant governor Michele Bullock says

- She says two interrelated channels exist whereby the housing market could have implications for financial stability: bank and household balance sheets

- In the case of a shock to household earnings or a dramatic drop in home values, a high level of debt may put the economy in danger

- Ms Bullock says the banks have strong balance sheets and lending standards are being maintained

The housing market has been one of the strongest performers in the Australian economy, but risks to financial stability could be building as prices and debt grow.

This is according to the Reserve Bank of Australia (RBA) assistant governor Michele Bullock, who said two interrelated channels existed whereby the housing market could have implications for financial stability: bank and household balance sheets.

The Australian banking system is heavily reliant on the property sector, with around 60 per cent of its lending connected to housing and with loans for small and medium businesses commonly using housing as collateral.

“A decline in housing prices impacts the value of that collateral but of itself does not necessarily lead to losses,” Ms Bullock said at the Bloomberg Inside Track webinar today.

“If there were an economic shock that resulted in borrowers being unable to service their debt, however, and at the same time housing prices fell sharply, the debt would be unable to be recovered in full by the sale of the property, resulting in a loss to the banks. If the losses were large enough the banks might exacerbate the decline by reducing their lending.”

Ms Bullock said there were two broad mitigants against this – lending standards and capital.

Bank lending standards and practices determine how much risk banks take on, standards the RBA is keeping a close eye on to steer clear of the lessons learnt during the Global Financial Crisis.

However, risks are integral to the business of banks, according to Ms Bullock, who said there was a balance to be struck. This is one that needs banks to manage risks by maintaining appropriate standards on who they lend to and how much they offer.

“Currently in Australia, the evidence suggests that lending standards overall have been maintained in the face of very strong demand for housing,” Ms Bullock said.

“The share of new lending at high loan to valuation ratios rose last year, in part reflecting an increase in the number of first home buyers who tend to have lower deposits. Lending at high debt to income ratios has also risen since early 2020.”

Ms Bullock said the other mitigant is capital, saying that banks that are well capitalised can absorb losses more effectively than previously.

“While the Australian banks did not have the undercapitalisation problems of some overseas banks, they now have even stronger capital positions than they did at the time of the GFC,” she said.

Another channel that could impact financial stability is the household sector.

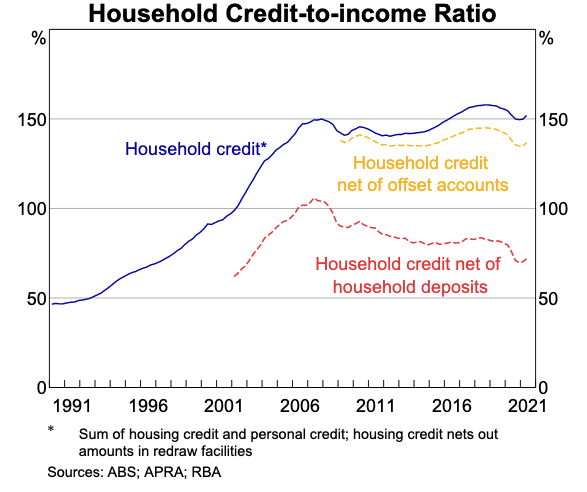

Mortgages account for the majority of household debt in Australia and over the past 30 years, household debt in Australia has risen dramatically.

Ms Bullock said the strong balance sheets at the banks would likely be able to absorb potential losses incurred from households not being able to service their loans, but said over-exuberance in the housing market posed another risk.

“Over-exuberance in the housing market can amplify these risks in two ways,” she said.

“First, rapid price rises can increase the likelihood that some new borrowers will over-stretch their financial capacity in order to obtain a new loan, making them more likely to reduce their consumption in response to a shock to their incomes.

“Second, if rapid price rises ultimately prove to be unsustainable they could lead to sharp declines in price and turnover in the future. This in turn could result in reduced spending, both directly as a result of a decline in turnover and through the wealth effect.”

In the case of a shock to household earnings or a dramatic drop in home values, a high level of debt may put the economy at danger, according to Ms Bullock, who said those macro-financial risks warranted close attention.