- Irongate Group’s (IAP) board rejects an unsolicited takeover bid from 360 Capital Group (TGP) and 360 Capital REIT (TOT) as the deal “undervalues IAP”

- Irongate received a proposal on Friday for 360 Capital to acquire all of the stapled securities which it didn’t already own for $1.6047 cash per stapled security

- IAP says its net asset value has increased to $1.61 per stapled securities as of 30 September 2021, following revaluations

- The IAP board evaluated the proposal and decided it fundamentally undervalues IAP and hence does not constitute a compelling proposition for security holders

- Shares in Irongate Group were down 1.25 per cent to $1.58 at the close of trading on Wednesday

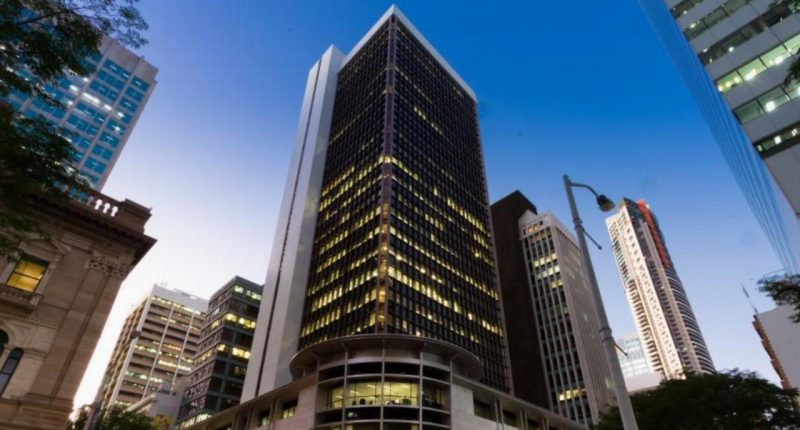

Irongate Group’s (IAP) board has rejected an unsolicited takeover bid from 360 Capital Group (TGP) and 360 Capital REIT (TOT) as the deal “undervalues IAP.”

IAP received an unsolicited, highly conditional and non-binding proposal on Friday for 360 Capital to acquire all of the stapled securities in Irongate which it didn’t already own for $1.6047 in cash each.

The price represented a 10 per cent premium on the last closing price when the proposal was lodged.

IAP said its net asset value has increased to $1.61 per stapled security as of 30 September, 2021, following revaluations.

The IAP board evaluated the proposal with its advisers and unanimously decided it fundamentally undervalues IAP and hence does not constitute a compelling proposition for security holders.

The IAP board believes the proposal does not adequately reflect IAP’s underlying value in terms of its office and industrial real estate portfolio, value-add upside potential embedded in the portfolio, and the value and growth potential of its third-party funds management business.

360 Capital said the proposal did not require an equity raise, but its internal capital resources were not identified and were subject to approval, and further conditional uncommitted third-party financing included ESR Australia and Citibank.

The IAP Board further observed that 360 Capital has not given any assurances about its capacity to fund the proposal.

The indicative proposal was also conditional on one or more of ESR Real Estate’s or its affiliate’s managed funds entering into an agreement with 360 Capital to purchase an undefined number of selected assets from IAP’s portfolio on terms that were to be negotiated.

The proposal also required JSE, FIRB, and other regulatory clearances, in addition to the IAP board’s unanimous endorsement.

Shares in Irongate Group were down 1.25 per cent to $1.58 at the close of trading on Wednesday.