- Some of Australia and New Zealand’s biggest listed businesses could unleash at least $24 billion in cash if they sold and leased back their real estate

- According to CBRE, owner occupiers have collected about $11 billion in the past five years through sale and leaseback transactions

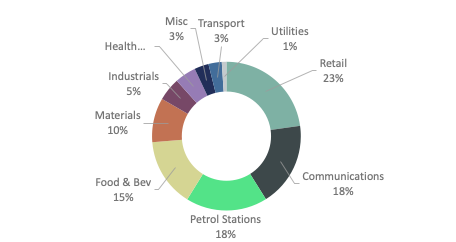

- Retail was the most actively traded property type, followed by petrol stations, communication assets, and food and beverage properties

- According to CBRE’s study, 25 owner occupier sales of more than $100 million each have released $9.5 billion in capital since 2015

Some of Australia and New Zealand’s biggest listed businesses could unleash at least $24 billion in cash if they sold and leased back the real estate properties they occupy.

This is one of the key findings of CBRE’s new report, Freeing Up Capital: Opportunities for Real Estate Corporate Owner-Occupiers. The report examines the land and buildings held on balance sheets by 40 ASX200/NZX50 listed companies across five sectors: materials, healthcare, telecommunications, transport and industrial.

According to CBRE, owner occupiers have collected about $11 billion in the past five years through sale and leaseback transactions.

Analyzing the $11 billion in owner occupier sales over the past five years reveals that retail was the most actively traded property type, followed by petrol stations, communication assets, and food and beverage properties.

Market Share of Owner Occupier Sales by Property Type

The analysis shows there is a substantial ongoing potential for listed corporates to examine these options in a low interest rate environment in order to capitalise on buyer demand for commercial real estate assets with strong tenancy covenants.

“Freeing up property assets from corporate balance sheets is an attractive way for organisations to redeploy the capital tied up in a low-yielding property back into their business at higher rates of return,” CBRE Pacific head of research Sameer Chopra said.

“This $24 billion monetisation opportunity could also be understated, given the recent strong performance of the industrial property sector, where owner occupier transactions have been particularly prevalent.”

CBRE Asia Pacific executive director of capital markets industrial and logistics Chris O’Brien said business said fundamentals were attractive for investors.

“There is also unprecedented demand for assets that are strategically positioned to be repurposed for the new economy,” he said.

Utilities may potentially be a lucrative area for property divestiture, according to Mr Chopra. However land and buildings in this sector are usually bundled in with power generating on company balance sheets, making determining the real book value of property assets in this sector more difficult.

The report revealed that owner-occupiers in these five sectors average a seven per cent capex to sales ratio, while 60 per cent have a return on equity in excess of 10 per cent.

According to CBRE’s study, 25 owner occupier sales of more than $100 million each have released $9.5 billion in capital since 2015.

This includes BP’s 2019 $1.08 billion sale to Charter Hall of a 49 per cent stake in 295 properties throughout Australia and New Zealand – the region’s largest owner-occupier portfolio sale to date.

However the majority of transactions have been lesser in scale, with 77 per cent of owner-occupier purchases under $50 million since 2015.