- Mirvac (MGR) purchases contentious land in Melbourne’s tightly restricted Princes Park neighbourhood

- The parcel of land was formerly held by Chinese developer JW Land, which sold it to Mirvac following years of planning disputes

- Mirvac secured the site for an undisclosed amount and plans to launch Park Street in mid-2022, with construction anticipated to commence in late 2022

- Mirvac rounded off the day of trading up 1.42 per cent, sitting at $2.86

Mirvac (MGR) has added to its residential pipeline in Melbourne for 2022 by purchasing a controversial site in the closely controlled Princess Park district.

The plot of land was originally owned by Chinese developer JW Land, which faced years of planning controversy.

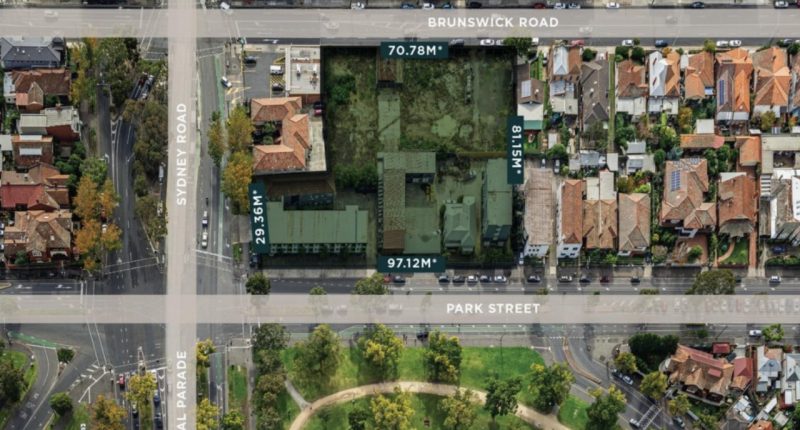

JW Land bought the parcel of land, 699 Park Street, in 2015 for $30 million and faced years of outrage and planning nightmares after proposing a development with multiple towers, one rising 13 storeys high, to house 333 units in 2016.

A year later it watered down its vision, but its proposal was also rejected by the local council, the state planning tribunal and its neighbours.

The developer decided to sell, and enlisted Trent Hobart, Jozef Dickinson and Hamish Burgess of Colliers International in May last year, looking for a reported $40 million.

Mirvac secured the site for an undisclosed amount but said it plans to launch Park Street in mid-2022, with construction anticipated to commence in late 2022.

The company said it has a strong track record working with authorities and local communities to deliver projects.

According to Mirvac head of residential Stuart Penklis, the renowned Park Street property provides a chance for Mirvac to strategically extend its pipeline and build a new legacy project at Melbourne’s northern entrance.

“Mirvac is focused on diversifying its portfolio across a range of different markets and is always looking for opportunities to create high-quality apartment offerings,” Mr Penklis said.

“In many ways the Park Street site echoes the essence of East Melbourne, an outstanding location with access to the best cultural amenity, right on the cusp of Melbourne’s CBD.”

Formerly a hotel, this one-of-a-kind location boasts unobstructed park and city views, as well as a 100-meter frontage on Princes Park.

“Demand from local owner occupiers looking for quality apartments in well serviced locations continues,” Mr Penklis added.

“More recently, we are seeing the trend towards Right Sizers, with families, couples and singles looking for larger apartments that offer a low maintenance, secure lifestyle, close to amenity — something that Park Street will offer in abundance.”

Park Street joins Mirvac’s $1.4 billion Victorian apartment portfolio, which includes 329 apartments at Apartments of Tullamore in Doncaster, 245 luxury residences at The Eastbourne in East Melbourne, and Yarra’s Edge in Melbourne, which currently has 3,000 residents with visioning for Tower 9 underway.

“Mirvac is in the early visioning stage for Park Street, with the current scheme looking to yield approximately 200 apartment residences in a range of configurations to appeal to a broad selection of purchasers,” Mr Penklis said.

“We have recently seen a trend towards oversized apartments and amalgamations which could see this number change.

“The current plans see the building at various heights stepping back from Park Street to minimise any impact on Princes Park and maximising the spectacular vistas for residents, but we are still in the process of finalising the scheme.”

Mirvac rounded off the day of trading up 1.42 per cent, sitting at $2.86.