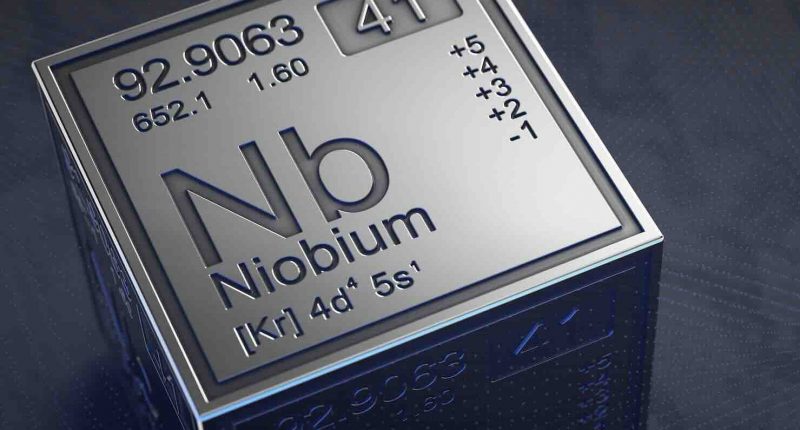

Power Minerals Ltd (ASX:PNN) has seen its share price rise by more than 19 percent on news that it is set to acquire a Brazilian project believed to be highly prospective for niobium, rare earth (REE) and lithium.

The company has entered into a binding Heads of Agreement to take on three permits comprising the Lĺtio Project, for a total area of 27 square kilometres, with the project being both immediately adjacent to and interpreted on strike from Summit Minerals’ (ASX:SUM) Equador Niobium Project.

The latter has picked up a number of high-grade results, including 53.07 percent niobium pentoxide (Nb2O5), 47.17 percent tantalum pentoxide (Ta2O5), and 24,760 parts per million (or 2.47 percent) partial rare earth oxides (PREO).

Additionally, results from Equador such as 34.45 percent Nb2O5 and 47.17 percent Ta2O5 have been found adjacent to the Lĺtio project, which also features outcropping pegmatites that will guide early exploration plans at the site.

A recent reconnaissance visit to the project confirmed that it featured similar geology to that of Equador.

Power Minerals Managing Director Mena Habib said that gaining this project would support the company’s goal of expanding its footprint in South America.

“Through this acquisition Power will build on the knowledge, expertise and local networks we have developed over the past eight years during our development of the Salta

Lithium Project in Argentina,” he said.

“Brazil is growing in stature as a sought-after location for minerals exploration and discovery and we are delighted to have secured this project, in an emerging exploration district where ASX-listed Summit Minerals has delivered positive results from its initial field-work.

“Along with indications of niobium, tantalum and rare earth results at Summit’s adjacent

landholding, we have identified outcropping pegmatites at surface at Lĺtio, which we plan to

test as an initial priority. Initial samples have been collected from site and we will use results

from their analysis to commence defining exploration targets at the Project.”

At 12:36 AEDT, Power shares were trading at 15.5 cents, a rise of 19.23 percent since the market opened.