- According to a recent study by the Property Investment Professionals of Australia (PIPA), interest rates do not propel property markets into booms or busts

- PIPA Chairman Peter Koulizos says affordability, local economic conditions, consumer attitude and access to finance all play an important role

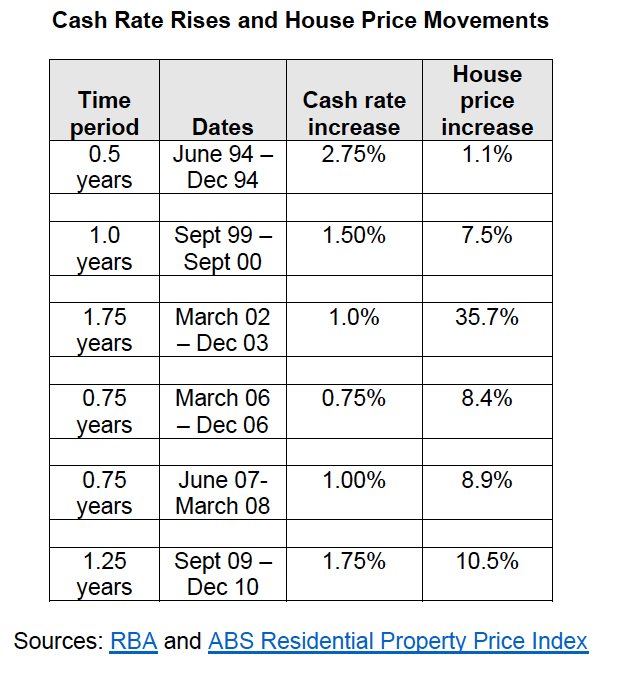

- PIPA examination of five periods of growing cash rate movements from 1994 revealed that property values continued to climb even after rate increases

- The Reserve Bank of Australia, which has kept interest rates at a record low of 0.1 per cent, hinted in its last monetary policy meeting that interest rates may rise in 2023

- Mr Koulizos says “alarmist” commentary being pushed in an attempt to frighten people into believing that when interest rates begin to rise, home values would decrease

According to a recent study by the Property Investment Professionals of Australia (PIPA), interest rates do not propel property markets into booms or busts; rather, affordability, local economic conditions, consumer attitude, or access to finance do.

PIPA examination of five periods of growing cash rate movements from 1994 revealed that property values continued to climb – sometimes dramatically – even after rate increases of up to 2.75 percentage points in only six months.

The Reserve Bank of Australia, which has kept interest rates at a record low of 0.1 per cent, hinted in its last monetary policy meeting that interest rates may rise in 2023.

According to PIPA Chairman Peter Koulizos, while the strength or weakness of property markets is frequently influenced by local economic factors, particularly affordability issues, data reveals that rate modifications are never the single underlying cause.

“There has been much conjecture over the past 18 months that record low interest rates are the singular reason why property prices have skyrocketed, when the cash rate was already at a former record low of 0.75 per cent before the pandemic hit,” he said.

“There are clearly a number of factors at play, including some buyer hysteria I’m afraid to say, but one of the main reasons for our booming market conditions is easier access to credit, which was simply not the case two years ago when rates were also low.

“At the end of the day, even when interest rates are low as they have been for years now, if people don’t have access to finance, it really doesn’t matter what the cash rate is.”

Mr Koulizos stated that certain “alarmist” material is now being pushed in an attempt to frighten people into believing that when interest rates begin to rise, home values would immediately begin to decrease dramatically.

Similarly, he said that there appeared to be considerable “scaremongering” about many borrowers being unable to afford their mortgages if interest rates rose by only one percentage point, citing excessive amounts of mortgage debt as examples.

“The latest ABS Lending Indicators showed that the national average loan size for owner-occupier dwellings was $574,000 in September, which shows that the vast majority of people are not racking up massive singular mortgages of $1 million or more,” Mr Koulizos said.

“While we don’t expect rates to rise for a year or two yet – and when they do, they are unlikely to ramp up rapidly – the monthly mortgage repayments on a $574,000 loan may increase by about $73 per week if the interest rate increased one percentage point. or from three per cent to four per cent.

“It’s vital to understand that new loans are already been stress-tested against much higher interest rates of about 5.65 per cent, so there is little to be gained by alarmist ‘forecasts’ that are just not supported by the data.”