Black Cat Syndicate (ASX:BC8) ended 2024 on a strong note, gaining producer status just in time for Christmas through the pouring of first gold from its Paulsens gold operation in Western Australia.

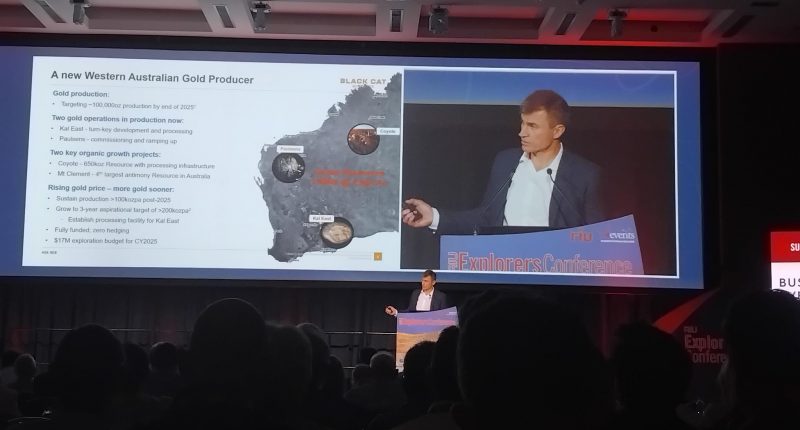

With this restarted (and refurbished) project now online, managing director Gareth Solley told investors at the RIU Explorers Conference in Fremantle that the company was aiming to reach 100,000 ounces (oz) production by the end of this year (2025).

But it wouldn’t stop there, Solley added, as Black Cat Syndicate had a doubling of that number in its sight.

“Happily we’re here as a producer now and, you know, this year is a big year for us,” he said.

“We’re planning to have a 100,000 oz per annum run rate by the end of the year. That will come from our two operating mines Kal East and Paulsens.

“We have a million ounces spread across our three projects, and once we get all of our projects up and running, ultimately, we have a goal of becoming a 200,000-ounce producer.”

The company aimed to achieve this goal within 3 years, and the plan would be underpinned by development of processing facility at its Kal East project, also in WA.

Mr Solley said that while Paulsens was impressive, he believed there was a lot more gold to find underground.

“We have the only gold processing facility within about a 400-kilometre radius, and we have lots of high-grade targets in that area,” he said.

“And there are certainly other companies like Dreadnought (ASX:DRE) with high grade gold targets in the area that could one day come into our mill.

“There are plenty of targets at Paulsens: The Main Zone Extension at depth, Apollo, we’ve got the Hanging Wall trend and Galileo.

“Is Paulsens the only million-ounce deposit in this area? Certainly, we don’t think so.”

At Kal East – which was the company’s main focus when it listed in 2018 – production was also on-track.

“We obviously do have a large resource: 1.3 million ounces just on the doorstep of Kalgoorlie,” he said.

“We’re producing from here right now, and it’s generating cash flow for us. But we want to have our own processing plant in Kalgoorlie.”

Engineering work was underway for this processing facility, with an initial capacity for processing 800,000 tonnes per annum, which will ultimately expand to 1.2 million tonnes.

Mr Solley said development activities at Kal East would include grade control drilling Fingals, and resource drilling at Queen Margaret, Imperial/Majestic, Trojan and Crown, and exploration drilling across the project area.

Black Cat Syndicate shares were trading at 77.5 cents per annum at 17:52 AEDT – a rise of nearly 5% since the market opened this morning.

Join the discussion: See what HotCopper users are saying about Black Cat Syndicate and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.