- An estimated $700 million worth of coal is currently being held up in Chinese waters, as Beijing’s unofficial ban on certain Australian imports continues

- A month after state-owned Chinese importers were reportedly told to halt orders from Australian coal producers, around 60 ships remain unable to offload their cargo and are currently idle in Chinese ports

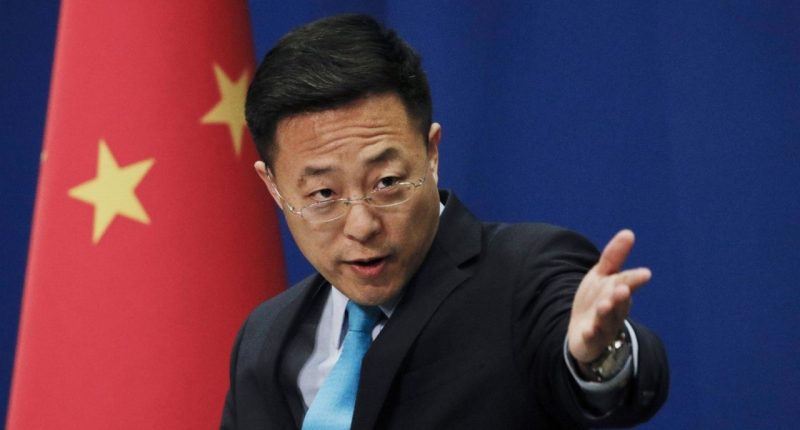

- In a recent press statement, Zhao Lijian, a spokesman for China’s Foreign Ministry, cited the government’s “environmental” concerns surrounding imported coal as the cause of the hold-up

- However, Zhao Lijian did not specifically highlight Australian coal as being of supposed poor quality, and Beijing has yet to provide an official reason for the apparent embargo

- Relations between the two countries have seemingly soured ever since Australian Prime Minister Scott Morrison called for an independent enquiry into the origin of the novel coronavirus

- Earlier this month, Australia’s Trade Minister Simon Birmingham said the export restrictions could cost the country $6 billion in annual trade

An estimated $700 million worth of Australian coal is currently being held up in Chinese waters, as political and trade tensions between the two nations continue to worsen.

Back in October, state-owned Chinese importers were reportedly told to halt orders from Australian coal producers. A month later, a recent evaluation by Bloomberg has estimated that around 60 ships are currently sitting idle in Chinese ports, with the majority holding Australian-produced coal.

When questioned about a ban on Australian coal imports, Zhao Lijian, a spokesman for China’s Foreign Ministry, alluded to quality issues as the cause of the delay.

“In recent years, China Customs has conducted risk monitoring and analysis on the safety and quality of imported coal and discovered imported coal not meeting environmental standards is relatively common,” he said, in response to a question on Tuesday.

Zhao Lijian did not specifically highlight Australian coal as being of supposed poor quality, and Beijing has yet to provide an official reason for the port hold-up.

The unofficial coal ban is just one of many apparent trade embargoes, which have hit Australian goods in recent weeks. Chinese importers have also reportedly been told to refuse lobsters, wine, sugar, barley, timber and copper ore originating from Australia.

Relations between the two countries have been strained ever since Australian Prime Minister Scott Morrison called for an independent enquiry into the origin of COVID-19. Tensions have further increased in recent weeks, as the Morrison government continues to criticise Beijing’s handling of pro-democracy protestors in Hong Kong, as well as the alleged treatment of the Uyghur people by Chinese authorities.

Earlier this month, Australia’s Trade Minister Simon Birmingham said the export restrictions could cost the country $6 billion in annual trade.