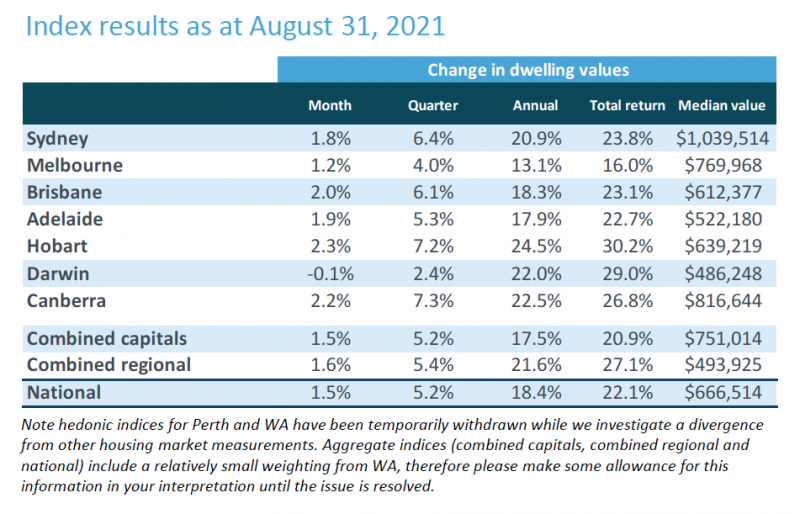

- Despite lockdowns, Australian property values have continued to grow, gaining 1.5 per cent across the country, according to CoreLogic

- The August report brings Australian house prices 15.8 per cent higher in the first eight months of the year and 18.4 per cent higher than a year earlier

- The yearly rise in national housing prices is roughly $103,400 or $1990 per week

- The August house value index confirms that the rate of price rise is slowing after reaching a peak in March of this year, according to CoreLogic

- Houses in capital cities continue to increase at a faster rate than units, although the performance difference appears to be closing

Despite the inconvenience caused by lockdowns, Australian home prices continued to grow broadly, rising 1.5 per cent across the nation.

According to CoreLogic’s national house value index, the rate is still far over average but is the slowest monthly increase since January.

This month’s figures do not include Perth and regional Western Australia “pending the resolution of a divergence from other housing market measurements in WA”.

The August report brings Australian house prices 15.8 per cent higher in the first eight months of the year and 18.4 per cent higher than a year earlier. The yearly rise in national housing prices is roughly $103,400 or $1990 per week. In comparison, salaries in Australia are growing at a 1.7 per cent yearly pace.

The August house value index confirms that the rate of price rise is slowing after reaching a peak in March of this year, according to CoreLogic.

According to Tim Lawless, research director at CoreLogic, the decreasing rate of growth is likely due to growing affordability restrictions rather than continued lockdowns.

“Housing prices have risen almost 11 times faster than wages growth over the past year, creating a more significant barrier to entry for those who don’t yet own a home,” he said.

“Lockdowns are having a clear impact on consumer sentiment, however to date the restrictions have resulted in falling advertised listings and, to a lesser extent, fewer home sales, with less impact on price growth momentum.

“It’s likely the ongoing shortage of properties available for purchase is central to the upwards pressure on housing values.”

According to Tim Lawless, the 18.4 per cent increase is the highest yearly rate of increase in house values since the fiscal year ending in July 1989.

“Through the late 1980s, the yearly rate of national house value increase reached 31 per cent, so the market isn’t exactly in uncharted territory,” he said.

“The yearly growth rate is currently growing higher; in fact, it is three and a half times greater than the thirty-year average rate of annual growth.”

Houses in capital cities continue to increase at a faster rate than units, although the performance difference appears to be closing.

Throughout the first quarter of the year, capital city home values increased at a rate that was roughly 1.1 percentage points faster than unit prices.

Mr Lawless feels that the convergence of rises in house and unit values might be another sign that affordability is becoming more difficult.