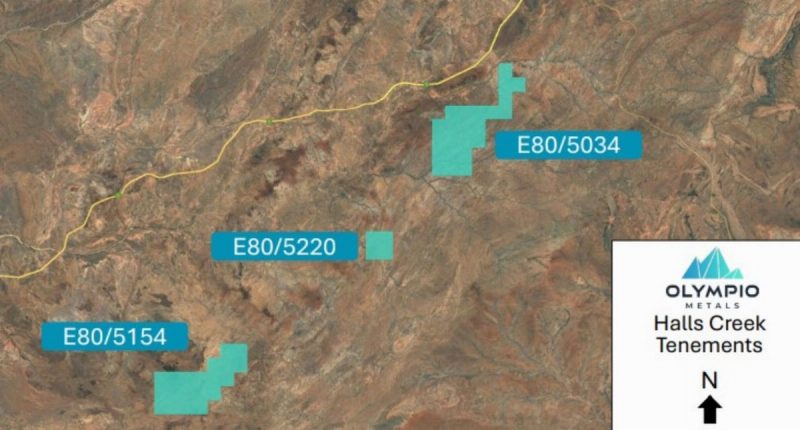

Olympio Metals (ASX:OLY) is selling its three tenements near Halls Creek in the east Kimberley region to instead focus on first drilling at its copper and gold project in Quebec.

Listen to the HotCopper podcast for in-depth discussions and insights on all the biggest headlines from throughout the week. On Spotify, Apple, and more.

The three tenements are being acquired by private company Clutch Group. Through an Option Agreement, Clutch has agreed to meet agreed minimum expenditure commitments on each of E80/5034, E80/5154, and E80/5220 during the due diligence period (which ends in June this year).

The sale allows Olympio to focus on the Dufay copper and gold project in Quebec, Canada, where a first drilling program will be beginning this month.

Olympio’s Managing Director, Sean Delaney, said activity was to ramp up there.

“The remaining Halls Creek tenements are considered non-core projects as we ramp up activity on our Dufay Cu-Au Project,” he said. “The option agreement with Clutch will ensure exploration expenditure on the ground up to June 2025 during their DD period and we wish them good luck with their work at Halls Creek.”

Clutch has paid Olympio an upfront exclusivity fee of $25,000 to undertake due diligence on the tenements, during which time Clutch will be responsible for maintaining the tenements and meeting an agreed expenditure commitment total of $80,000.

If Clutch then proceeds with the deal, it’ll pay Olympio up to $150K in option fees across the three tenements.

Beyond that, Olympio would receive performance payments on a measured JORC resource above 50,000 ounces of gold of minimum grade 1gm/t ($100,000), and another $100,000 within 10 days of a decision to mine.

OLY last traded at 3.9 cents; it has a market cap of about $3.4 million.

Join the discussion. See what HotCopper users are saying about Olympio Metals and be part of the conversations that move the markets.

The material provided in this article is for information only and should not be treated as investment advice. Viewers are encouraged to conduct their own research and consult with a certified financial advisor before making any investment decisions. For full disclaimer information, please click here.

-1200x645-380x200.jpg)