- The Perth industrial and logistics market is benefiting from strong economic growth, according to a JLL report

- According to the report, the logistics and manufacturing sectors drove the majority of occupier demand between 2020 and the first half of 2021

- The spike in eCommerce activity, along with improvements in manufacturing activity, has resulted in unprecedented levels of industrial occupier activity in Perth, JLL says

- With two-quarters of activity left to be recorded for the current year, the entire take-up number for 2021 has risen to 160,300 sqm, exceeding the overall figure for 2020

The Perth industrial and logistics market is benefiting from strong economic growth, while recent expansion in the eCommerce and manufacturing sectors is driving occupier demand to new highs.

A new industrial market report titled ‘In Sync’ authored by JLL director of research Ronak Bhimjiani shows that strong economic performances are contributing to positive trends in the industrial market.

According to the report issued today, WA’s economy is rising at its quickest rate since 2012, with local economic growth above that of other developed countries. WA’s economy is predicted to maintain its excellent growth, fueled by pandemic-induced expenditure in global infrastructure projects, which will result in strong WA commodities exports.

Furthermore, once WA’s vaccination targets are met, it is expected that interstate and foreign migration would accelerate the state’s economic growth, owing to enhanced lifestyle, affordability and long-term employment opportunities.

“Strong economic performance is the backbone behind recent positive trends across the Perth industrial market,” Mr Bhimjiani said.

“If you look at the top performing labour market sectors in WA, logistics leads the way with employment growth up 31 per cent versus pre-COVID levels. Other industries such as manufacturing (up 20 per cent), mining (up 14 per cent) and construction (up 4 per cent) are also major contributors to labour market growth in recent times.”

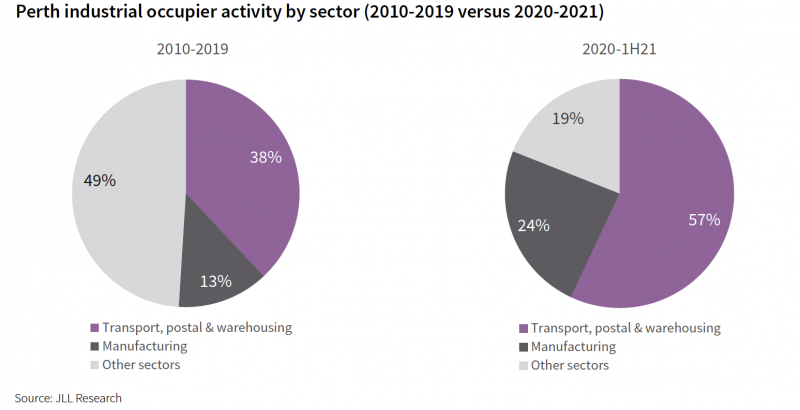

According to the report, the logistics and manufacturing sectors drove the majority of occupier demand between 2020 and the first half of 2021, accounting for 81 per cent of total take-up during this time. In comparison, the long-term average take-up rate for industrial space across both sectors is 62 per cent.

Over the 18-month period to June 2021, the logistics sector represented 57 per cent of take-up, exceeding the long-term average of 38 per cent, with JLL Research anticipating that growth in the eCommerce sector will create demand for an additional 800,000 sqm of industrial and logistics space over the next five years.

“The rapid rise of the eCommerce sector, stemming from a structural shift in how and where consumers shop has become a dominant force within the retail sector,” Mr Bhimjiani said.

“Australia’s eCommerce penetration rate, which as a proportion of overall retail sales has increased from 9.6 per cent in 2020 to 13.3 per cent in June 2021, is expected to increase to 20 per cent by 2025. The global eCommerce penetration rate is 22 per cent, which means we still have a lot of catching up to do.”

The WA manufacturing sector has recovered, aided by increasing engineering construction activity, which is up 13.2 per cent year on year as of June 2021, the report found.

As a result, the manufacturing sector has increased its need for industrial space (contributing 24 per cent of take-up between 2020 and the first half of 2021 versus the long-term average of 13 per cent).

“A surge in demand within the mining and construction industries is driving the manufacturing sector,” Mr Bhimjiani said. “As such, tenant activity from steel, aluminum and timber fabrication specialists has increased significantly.”

The spike in eCommerce activity, along with improvements in manufacturing, has resulted in unprecedented levels of industrial occupier activity in Perth. Industrial take-up totalled 87,400 sqm in 2Q21 alone, the highest quarterly amount ever recorded.

With two-quarters of activity left to be recorded for the current year, the entire take-up number for 2021 has risen to 160,300 sqm, exceeding 2020’s overall figure of 105,200 sqm.

Strong demand for industrial property, combined with restricted supply, has resulted in an increase in land, rent and capital prices, putting downward pressure on transaction yields.

The rise in the value of the industrial market has resulted in an increase in the sector’s market capitalisation. Based on 7.7 million square metres of gross lettable space, the research estimates Perth’s industrial and logistics commercial market to be worth $13.1 billion.

“We believe the sector will continue to demonstrate notable growth over the decade, with our projections indicating that Perth’s industrial market cap will reach AUD 15.3 billion by 2025 and AUD 17.2 billion by 2030 (up 31 per cent from the current level),” Mr Bhimjiani concluded.